Aging Accounts

In the credit, collections and accounts receivable industry, there is a reason for urgency in all business functions. That reason is aging accounts.

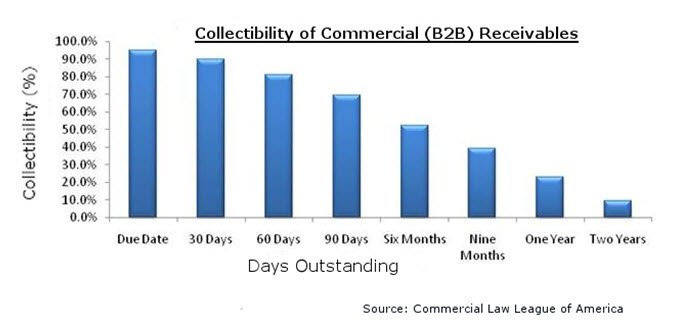

When accounts receivables age, the probability of collecting and the likelihood of collecting the full amount owed decreases. As time passes, the debt goes unpaid while cycling through the process of accounts receivables management, and then collections. Eventually, the likelihood of collecting is so slim that there may be no use in trying.

What does this mean for your company?

As a credit-extending company, it’s important to be proactive and collect as quickly as you can. Good customer and/or client communication is key to reducing the Days Sales Outstanding (DSO)—that is, the length of time between credit being extended and collection of the amount. If you find that the DSO is increasing for your company, there are several ways to improve the turnaround time:

Know your customer demographics to optimize contact mechanisms

If your company has many late payers, perhaps you need better ways to stay in contact with customers. It could be that customers need a better platform for managing their debt, such as an app or online platform. Or maybe you don’t have customer service representatives who are easy to contact and speak with.

This is when knowing your clientele is important, by more that just knowing how to sell to them. For example, if your clientele is mainly age 18-30, you may consider developing an online platform for paying bills. This improves accessibility. On the other hand, if a large percentage of your clientele is much older, they may prefer speaking on the phone or sending checks in the mail. Know your customers and make available several ways of paying bills to improve Days Sales Outstanding. In the same vein, make sure that consumers are satisfied by having in place feedback avenues. Hearing directly from customers can help you determine what actions you need to take.

Use live agents for servicing and collections, instead of relying on data alone

Although data companies seem very convenient, the fact of the matter is that the information they provide may be old. In other words, the data is not always correct and is often outdated. Using a data company as your sole information provider can result in increased risk, as can ATDS calling. Consumers do not respond well to ATDS, which decreases the likelihood of collecting because the consumer is more likely to hang up.

Instead, try using live agents for both verification and collections. There are many companies who operate in this way, and the benefit to you is that the phone numbers are more likely to be correct. The faster you’re able to contact the right person, the faster your collections will be.

As a collections agency or accounts receivable department, this means that the faster and more efficient your processes are, the better. If you have the opportunity for live calling to consumers you’d better take that opportunity, because waiting to receive data about consumer contacts without any action will result in greater financial losses for your company. Uncollected debt is lost revenue which your company shouldn’t write off until you’ve tried to collect as much of the debt as possible.

Aging accounts inspire urgency, so don’t wait. Use a company with live agents to collect the largest percentage of debt.